The dawn of the solar age

We are at an historic junction of human history in which we are transitioning from the age of fossil fuels to the age of renewable and distributed energy, in effect a true paradigm shift.

PETER LYNCH

We are at an historic junction of human history in which we are transitioning from the age of fossil fuels to the age of renewable and distributed energy, in effect a true paradigm shift. The tide has turned and the worldwide momentum is irreversible. This change is occurring all around the world and has been accelerating dramatically in the last three years.

One of the critical factors in this accelerated transition is plain and simple – economics.

Renewables are in fact cheaper than all forms of fossil fuels when you compare all of the relevant factors – initial cost, timing of cash flows (cost of money), absence of any variable costs for decades, superior job creation by a number of magnitudes, no pollution and huge resultant cleanup costs and few if any health related costs.

The truly interesting and significant dichotomy in this transition is that at this time the greatest threat mankind has every faced – Climate Change, is upon us and must be addressed immediately and at the same time Climate Change also presents us with the greatest investment opportunity of all time!

Climate Change must be addressed and by far the fastest and cheapest way to address it is with existing renewable technologies – solar, wind, biomass and working together connected to distributed energy networks that are far more flexible, extremely resistant to disruption (storms, terrorism) and have a significantly higher reliability.

The investment areas are just starting to appear and present themselves and many more will arise as the transition accelerates. It will be the savvy and aware investors and corporations that will take advantage of it.

Why it is the Dawn of the Solar Age

It is the dawn of the solar age because solar and wind are simply: Better, Faster and Cheaper!

Better – it is clean, pollution free, abundant, available everywhere, has far less financial risk and is the only energy source that dramatically strengthens national security.

Faster – solar scales up as much as 15 times faster than nuclear or fossil fuel plants. There is simply no comparison when it comes to speed of building and the time value of money involved.

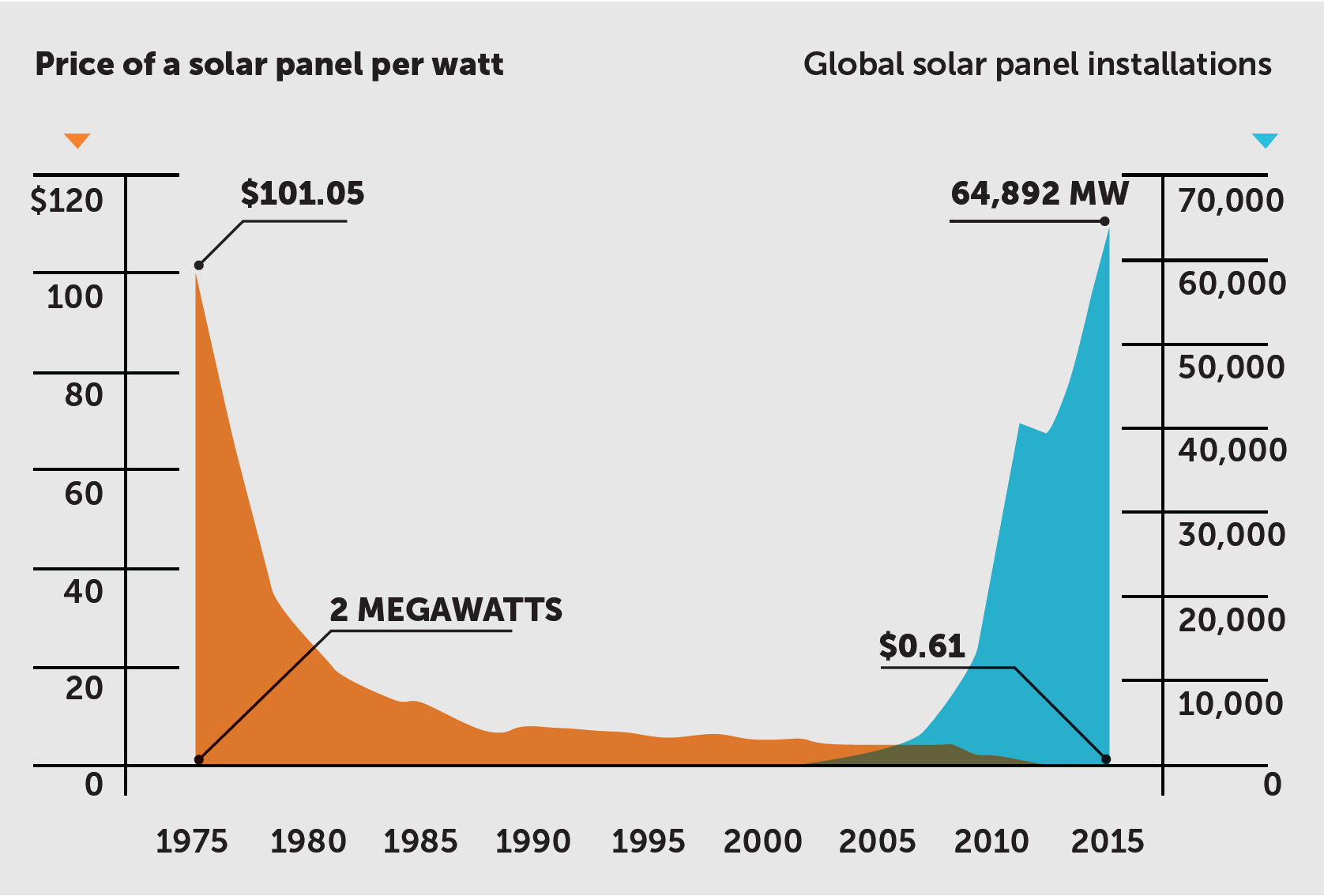

Cheaper – due to recent dramatic decreases in price (62 per cent for wind and 82 per cent for solar) in the past five years. These decreases have continued in 2015 and are projected to continue in 2016 and beyond. These do not include other external costs (pollution, health etc.) that are far greater.

The intrinsic advantages of solar are dramatic and insurmountable

Solar is abundant, can be utilised in almost any size (wrist watch to city) and available everywhere. One could say that it is the most “democratic” form of energy in existence.

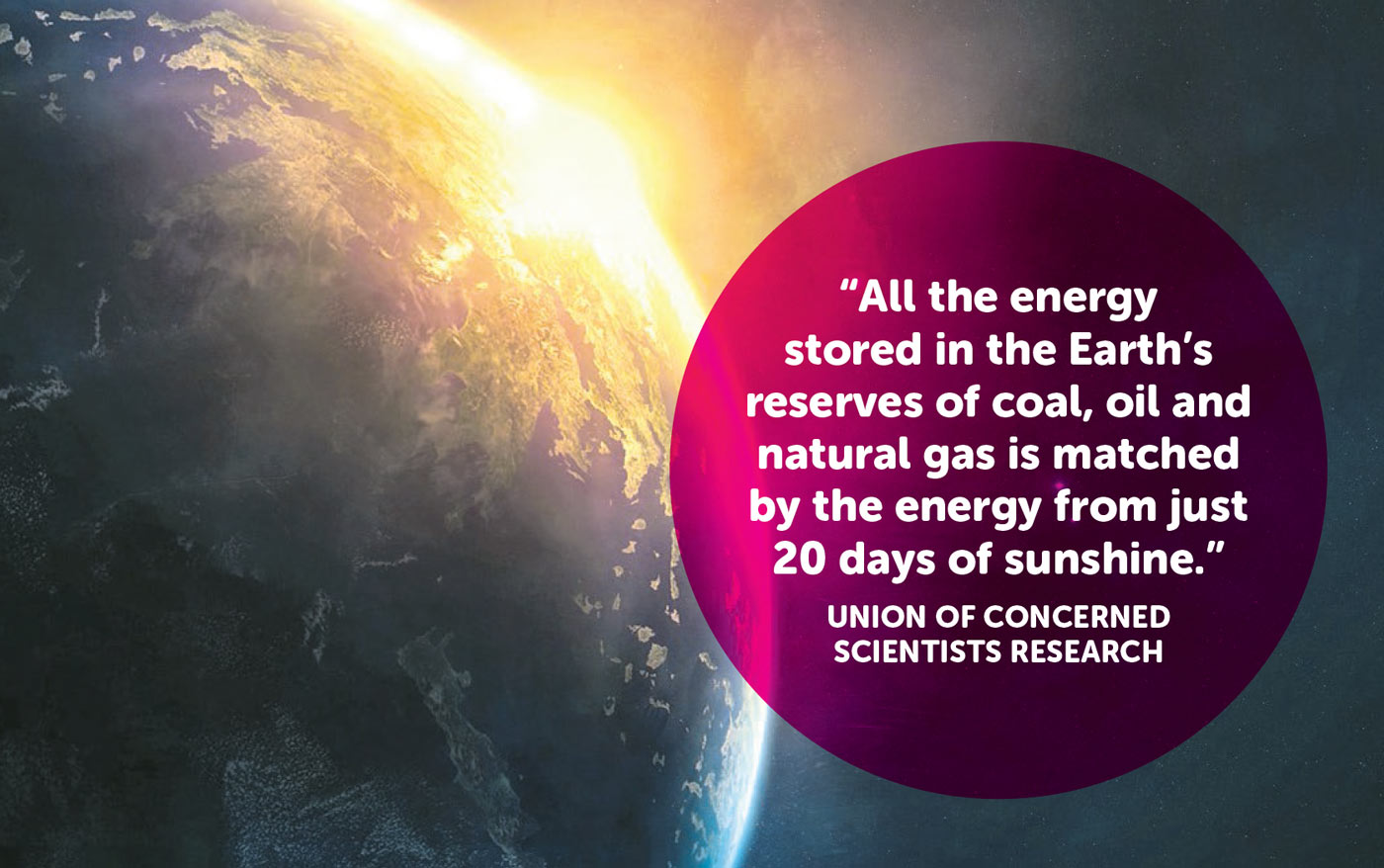

Solar is renewable and is not finite as are all other fuels and it is the only source of energy that can easily supply all our long term needs. ** The energy from approximately two weeks of sunshine hitting the earth is greater than ALL the energy stored in existing fossil fuels.

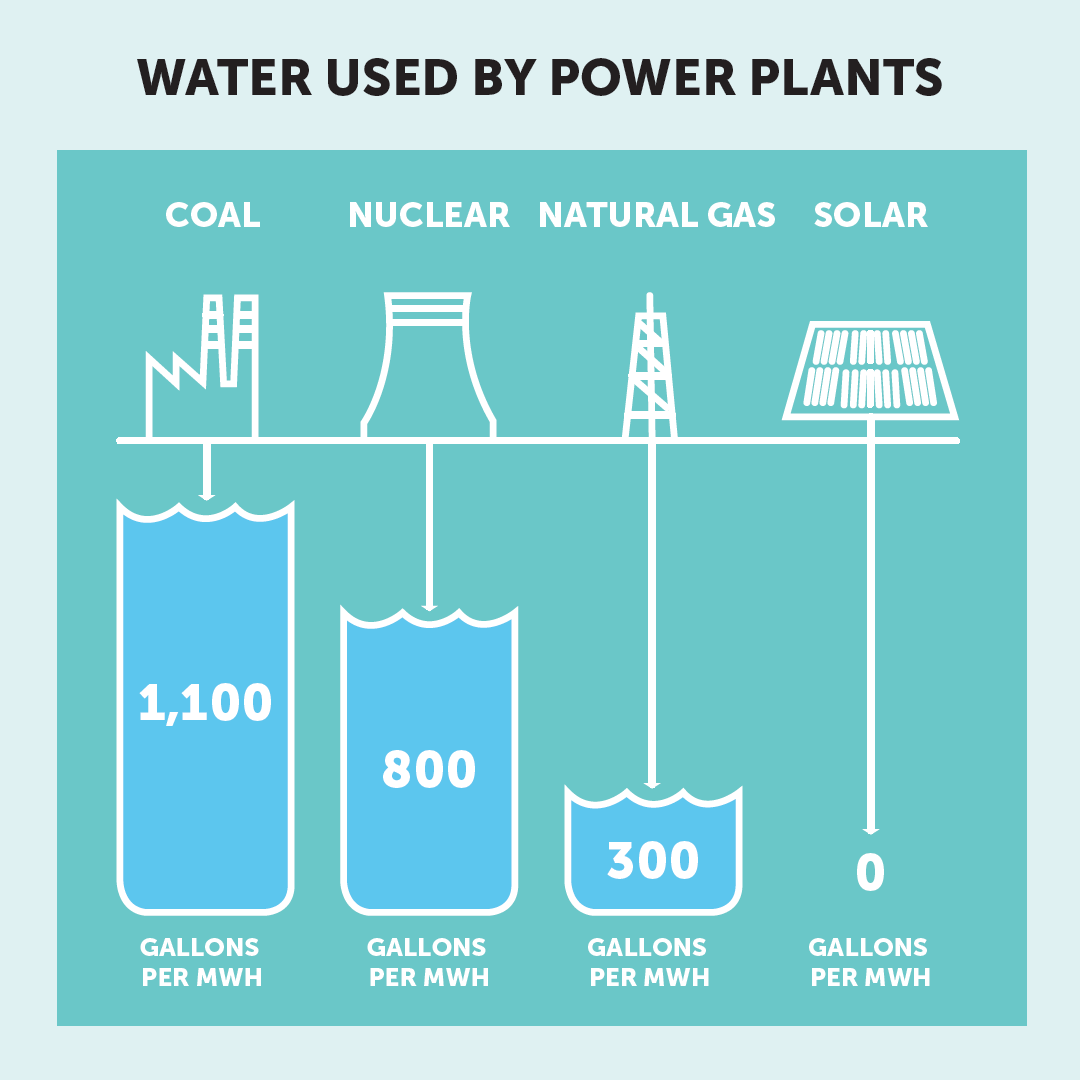

Solar is the only energy generation technology that does not utilise (and pollute) vast amounts of fresh water. This is a key advantage that is seldom mentioned. However, it is without question, an advantage that is insurmountable.

Solar is the only energy source that does not create or emit carbon and further contribute to climate change.

Why investing is different when a ‘paradigm shift” is occurring.

One of the “old” contrary adages in stock market investing is: “this time it is different” – it is generally associated with novice investors who most of the time, lose money.

It is a true that most of the time – things are the same, but during a paradigm shift – the old rules go out the window and a dramatically different playing field presents itself to investors.

It has happened before when personal computers (distributed computing) over took main frame computers (centralised computing) and it is happening now with distributed renewable energy technologies overtaking antiquated centralised energy generation.

The risk of investing in huge power plants that have 30+ year lives when there is the distinct possibility that they could become negative cash flow nightmares is simply gigantic. With efficiency improvements and solar the electricity demand worldwide has been decreasing for the first time ever. This will certainly lead to dramatic decreases in revenues and likely long term negative cash flows.

Likewise investing in assets (oil, coal, gas) that are in the ground also presents an unacceptable level of risk to any investor. These assets could become stranded as a result of climate change or simply they will cost too much compared to renewables to extract. In the U.S. there has recently been (2015) debate about colleges and state pension funds divesting their portfolios from investments in coal.

With all due respect to pension fund analysts, over the past four years the S&P 500 index (SPX) has been UP approximately 160 per cent while Coal ETF’s have been down between 80 and 90 per cent – their performance could frankly not be worse. I do not know what the analysts were looking at, just let me just say that I am not familiar with that particular investment strategy and would not recommend utilising it. The recent activity in the oil sector also illustrates the growing risk.

The end of the fossil fuel era is approaching and the trend is irreversible. It is simply another example of the capitalist process of creative destruction that has taken place in many industries over the last 100 years and a huge investment opportunity.

“We are like tenant farmers chopping down the fence around our house for fuel when we should be using nature’s inexhaustible sources of energy – sun, wind and tide … I’d put my money on the sun and solar energy. What a source of power! I hope we don’t have to wait until oil and coal run out before we tackle that”. Thomas Edison

Renewable Energy Related Stocks

Below are a number of my favorite stocks at this time to take advantage of the transition to renewables. Note: these stocks are currently in the highest rated category in my proprietary stock evaluation system.

Solar Electric (Photovoltaic) related Stocks

First Solar – symbol FSLR, trades on NASDAQ

- First Solar is the largest solar company in the area of Photovoltaics (sunlight to electricity)

- It has excellent management that has been exceptional in making or exceeding their projections regarding revenues and technical progress.

- They have the strongest balance sheet in the industry and a strong backlog

- They utilise a proprietary thin film technology that performs better in warm and hot climates than the industry standard solar panel made of crystalline silicon. This would be an advantage in many of the countries where there is substantial sunlight.

8Point3 Energy Partners LP – symbol CAFD, trades on NASDAQ

- 8Point3 Energy Partners is a Yield Co. this is a company that is created as a public vehicle in which to place large solar projects as assets which generate cash flow. It gives investors a nice way to play the solar sector plus a competitive yield (5.6 per cent) while providing a source of financing for the yield company’s solar company partners. CAFD is in my top category.

- 8Point3 Energy Partners solar company partners are First Solar and Sunpower Corporation two of the top solar companies. First Solar is in my top category and Sunpower is in the next category. This is a good category and usually suitable for a purchase and

may attain top status, but for now is a good company just not in my top investment category.

Wind Companies

Gamesa Corporation (GAM – Spain) and Vestas Wind (VWDRY- NASDAQ)

- Gamesa (Spain) and Vestas (Denmark) are two of the largest Wind companies in the world. Both are in my highest category and both have had very strong business and very large backlogs.

- Both will likely participate in the worldwide boom in onshore and off shore wind parks a market which is expected to grow at an accelerating rate over the next five to 10 years.

- Both are well positioned and have quality products with long histories in the industry and also active development programs to keep ahead of the curve.

- Another very large wind player is General Electric, but wind if not a dominate part of their business so it would not qualify as a “pure play” on wind. Also note that GE is a large shareholder in First Solar and shares some intellectual property – as a result I would not be surprised (pure speculation on my part) that at some unknown time in the future FSLR may be acquired by GE.

Renewable Energy Infrastructure Investment

Hannon Armstrong (HASI)

- Hannon Armstrong Sustainable Infrastructure Capital, Inc. is the leader and first to market in the sustainable investment area. It provides debt and equity financing to the energy efficiency and renewable energy markets. The company focuses its investment activities primarily on energy efficiency projects, renewable energy projects and other sustainable infrastructure projects.

- The company has a large backlog and has a healthy dividend (6.8 per cent) for shareholder to enjoy as the company continues its growth.

comments